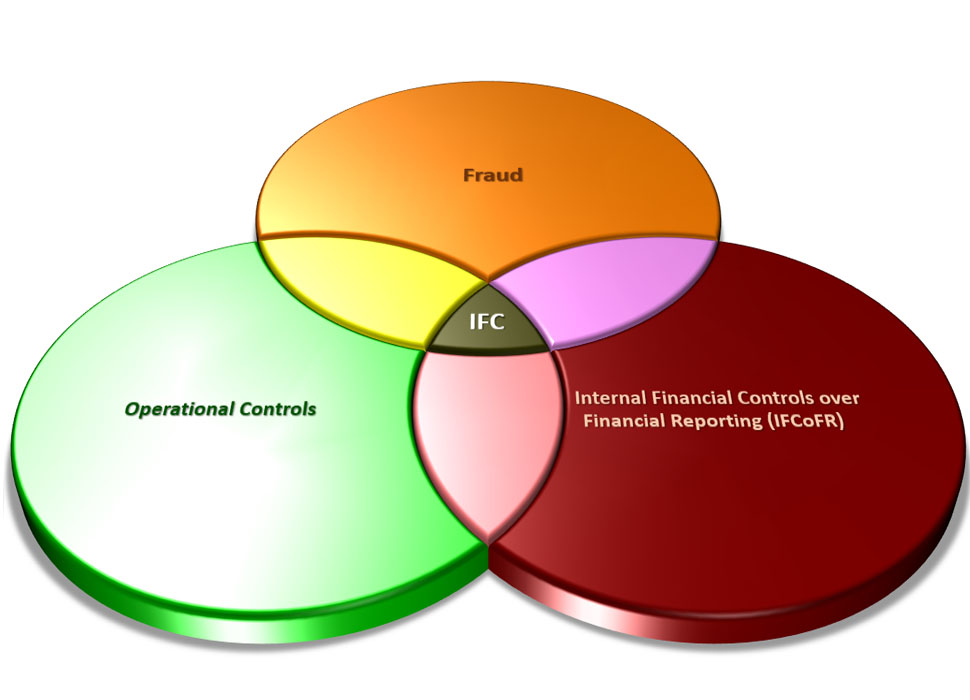

Internal Financial Controls (IFC) under Sec 134 of Companies Act, 2013 marks a paradigm shift from the previous reporting requirements, taking the level of corporate governance in India to new heights. IFC, in nature, is quite similar to SOX Act and mandates certain responsibilities on the Board, Audit Committee, Senior Management and the Auditors.

IFC means policies and procedures adopted by an organization for ensuring:

- Efficient conduct of its business.

- Safeguard its assets

- Prevent and detect frauds and errors

- Accuracy and completeness of accounting records

- Timely preparation of transparent and reliable financial statements

InQHive assists it clients by preforming a comprehensive review of the control environment of an organization in accordance to the requirements of the Companies Act, 2013. Our team are experienced professionals on such control reviews and can provide great extent of assistance in adopting to the relevant Internal Financial Controls frameworks on the basis of ICAI Guidance Notes.